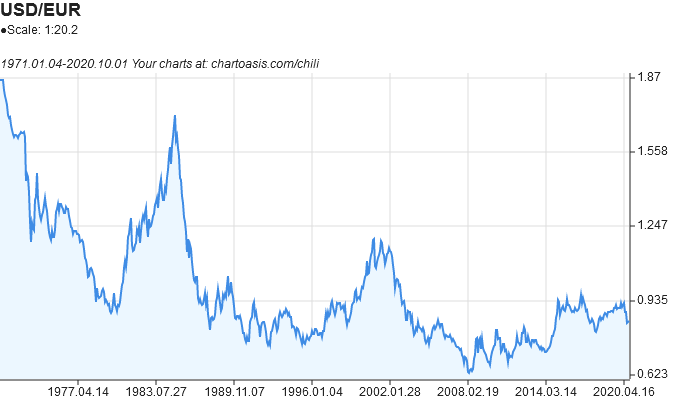

On popular ECN accounts, the spread is usually less than 1 pip. Due to the highest liquidity, the spread for the EUR/USD pair is minimal. Spread is one of the main advantages of this pair. But in general, if you look at the historical data, the average daily volatility of the EUR/USD pair is about 80 pips. During the release of important data, the pair is capable of making strong movements from 100 points and above. Volatility - the EUR/USD pair is characterized by medium volatility. At this time, the largest trading volumes take place, and the main movements of the EUR/USD pair take place. It is most active during the European and American trading sessions. Let's consider the main trading characteristics of this pair:Īctive trading hours - the pair is traded around the clock except for weekends. Conversely, if there is a decline in growth rates in the US and the Eurozone demonstrates good performance, the EUR/USD pair will grow. If the US economy is growing steadily, and problems arise in the EU, this might cause a EUR to US dollar fall. The behavior of the EUR/USD pair is a kind of indicator showing the comparative state of the US and EU economies. It is in the euro/dollar that the largest volume of transactions is made during daily trading on the Forex market (approximately 20% of the total volume). This is not surprising, as it includes two of the world's major reserve currencies: USD and EUR. The EUR/USD pair belongs to the major currency pairs (majors) and is characterized by increased liquidity. Below, you can see an interactive chart from Forex in real-time:Ĭharacteristic Features of the EUR/USD Pair

The current rate of the EUR/USD pair is $1.08127. Which Factors Affect the Quotes of the EUR/USD Currency Pair?.Long-Term Euro to USD Forecast 2025-2026.Analytical Agencies’ EUR/USD Forecast for the Rest of 2022.Euro/dollar weekly price forecast as of.The article covers the following subjects: Let’s go more in-depth in this Euro to Dollar forecast. Simultaneously, a large part of the pricing is also related to 'event' risks that cannot be gauged in advance.

The Euro/US dollar rate is subject to such factors as interest rate differences, inflation, jobs data, trade, and capital flows. Moreover, the EUR to US dollar rate may reflect the overall global market sentiment.Īs the pair is widely traded, it may be hard to forecast its rate for the long term. The direction of EUR/USD may reflect the strength of either the EU or US economy. However, traders around the globe try to predict its future price for more than opening successful trades. It means that it’s one of the most traded pairs in Forex. EUR/USD is one of the major currency pairs.

0 kommentar(er)

0 kommentar(er)